45l tax credit multifamily

Taxpayers also have the ability to amend returns to claim missed. The credit allows eligible contractors to claim a 2000 tax credit for each newly constructed or substantially reconstructed energy-efficient home in the year that unit is sold or leased as a residence.

45l Tax Credit Energy Efficient Tax Credit 45l

The tax credit was used to offset many of the costs for the upgrades.

. The Act has extended the 45L credit for qualifying units initially leased or sold through December 31 2021. Earned a 500000 45L tax credit. 45L Tax Credits For Multifamily Dwellings.

About the 45L Credit Extended by the Consolidated Appropriations Act CAA in 2021 the 45L credit is a tax incentive available to home builders and multifamily developers. Its ability to be applied to substantial reconstruction and rehabilitation as referenced in the Section 45Lb3 is often overlooked. 45L Tax Credit - Energy Efficiency Tax Credits for Multi-family Developers.

Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements. Section 45L or Energy Efficient Residential Tax Credit has been recently extended through the end of 2021. Each newly contractor built energy efficient residential dwelling purchased from the contractor and used as a residence over the last few years is eligible for.

The bill extends the tax credit for another. This credit provides a dollar-for-dollar offset against taxes owed or paid in last three years on property sold or leased. If you qualified for the credit but did not take advantage of it in previous years your tax returns can be amended for up to three past years2017.

45L is a federal tax credit for energy efficient new homes. Section 45L Federal Energy Tax Credit. Posted on January 29 2015 by Steve Nanos in 45L Tax Credit.

The credit provides a dollar-for-dollar offset against taxes owed or paid in the tax year in which the property is sold or leased. If you are a developer that has built a low-rise multifamily property the 45L tax credit could benefit your company. Section 45L is a tax credit of up to 2000 for each new or rehabilitated energy-efficient dwelling unit that is first leased or sold by the end of 2021.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. 133 signed into law by President Trump on December 27th extended the 45L energy efficient home 2000 tax credit which had been. The 2000 tax credit per building unit is available to developers and builders of properties that are 50 more energy-efficient than a similar property built in 2006.

Finally low-rise multifamily properties three stories or less may qualify for a 2000 per unit tax credit for new residences that achieve a 50 percent energy savings for heating and cooling over the 2006 International Energy Conservation Code IECC and supplements. Homebuilders of single-family homes or developers of low-rise multifamily developments may qualify as an eligible contractor for the 45L credit. The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in the year that unit is sold or leased as a residence.

The tax credit is 2000 per residential dwelling unit. Section 45L tax credit is a credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties. By Stuart Kaplow on January 10 2021 Posted in Energy Federal Green Building Green Globes IgCC LEED.

The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards. The Section 45L tax credit which rewards multifamily developers with tax credits of 2000 per energy efficient apartment unit. How do you know if your property qualifies.

And you could receive a 2000 per unit tax credit. The Act has extended the 45L credit for qualifying units initially leased or sold through December 31 2021. 45L is for residential and multi-family properties.

Section 45L Tax Credit. There seems to be some confusion concerning the terms and the exact conditions of the section 45L credit. 45L Energy Efficient Home Tax Credit Extended for 2021 by Covid Relief Bill.

If youre renovating or rehabbing a multifamily property with three-stories or feweror have previously done soyou could be eligible for the 2000unit tax credit if the improvements both. The Tax Increase Prevention Act of 2014 allows the incentive to be claimed retroactively for all residential developments built within the last three years and any unused credit can be carried forward for up to 20 years. The latest retroactive extension that made the credit available for projects executed by the end of 2014 has generated.

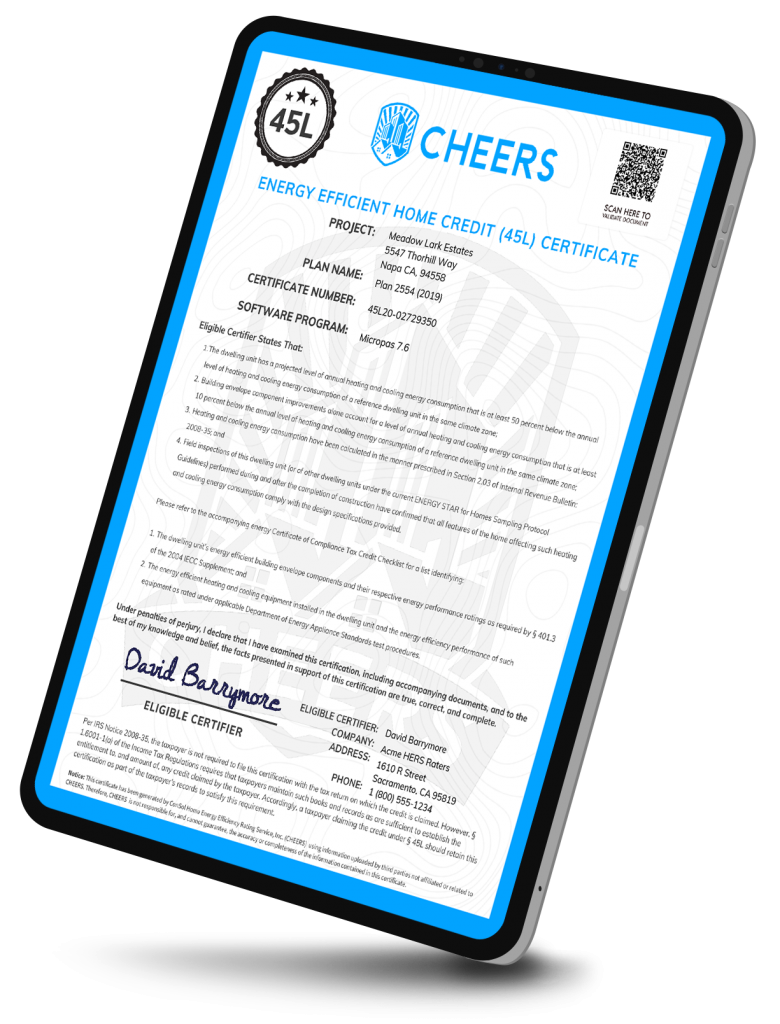

Most eligible multi-family projects qualify for the 2000 Energy Efficient Home Tax Credit due to strict California building code. With CHEERS Energy Consultants and HERS Raters can now qualify additional dwelling units ADUs multi-family apartments and condominium projects for the 45L tax credit. Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are eligible for a 2000 tax credit for each new or rehabbed energy efficient dwelling unit that is first leased.

The Consolidated Appropriations Act 2021 HR. Newly constructed or renovated apartments and condominium developments of three stories or less that meet certain criteria are eligible for a 2000 credit per unit under section 45L of the. Submit the contact form at the bottom of the page or call 804-225-9843 to find out how to take advantage of the 45L Tax Credit.

The Section 45L tax credit had expired at the end of 2011 but this bill extends the tax credit for two years through 2013. What is the 45L Tax Credit. Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011.

Key provisions impacting the multifamily industry include the following. The incentive applies to single-family homes as well as condominiums apartment complexes and other multifamily residential buildings whereby each unit may qualify for a 2000 credit. The taxpayer touted having Green Living in.

Among other extensions this bill retroactively extends the Code Section 45L tax credit providing multifamilyapartment builders with a tax credit of 2000 per energy efficient unit. Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties. Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each energy efficient dwelling unit is retroactively available for projects placed in service from 2018 to 2020 and through the end of 2021.

Ascent Multifamily Accounting professionals have experience in helping owners and developers secure various types of tax credits for their multifamily developments. A 2000 tax credit in the year that unit is sold or leased as a residence. On January 2 2012 President Obama signed the American Taxpayer Relief Act of 2012.

An Energy Efficient Homes Tax Credit IRC Section 45L.

Ema Brayn Consulting Llc Cohosting Webinar On Tax Incentives For Energy Efficient Designers 2021 05 19 Building Enclosure

Don T Miss Out On Potential Energy Tax Credits For Your Projects

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services

45l The Energy Efficient Home Credit Extended Through 2017

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

179d Tax Deductions 45l Tax Credits Source Advisors

Everything You Need To Know About 45l Tax Credit Mom And More

Tax Benefits For Multifamily Rehabilitation Property Projects

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

45l Home Credit 2 000 Tax Credit For Going Green

Section 45l Tax Credit Case Study Apollo Energies Inc

Tax Benefits For Multifamily Rehabilitation Property Projects

Affordable Housing Developers Investors Additional 2 000 Tax Credit

45l Tax Credit Energy Efficient Home Credit For Developers Baker Tilly

Tax Credit Extended For Home Builders Multifamily Developers Bkd

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas